India’s Global Competitiveness in Textiles and Apparel

Bamboo Yarn

India’s textile and apparel industry can be labelled as that rocket which zoomed off to the skies but lost its fizz somewhere in between. Despite being the second-largest exporter of textiles and accounting for 5% of the global share of textiles and apparel, India’s first runners up crown face stiff chances of being taken away by smaller countries like Vietnam and Bangladesh. Currently, India ranks second only to the manufacturing giant China but whether this position will go up or down vastly depends on certain factors.

If we analyse India’s productivity in textiles and apparel and compare it with its competition across the world, the following five points play a deciding role in establishing India’s position globally:

1. Scale: The success of any manufacturing unit largely depends on the scale on which it can produce the product. Labour, land and machinery are the key factors which determine the scale of production of any industry. Luckily for India, labour is not only cheap but also plentiful due to its high population and unemployment. The textile industry employs about 105 million people, directly and indirectly, making it the second-largest provider of employment in India after agriculture. India has a huge advantage due to lower wage rates as compared to other developed countries. Also, the prevalence of the gig economy ensures that organisations do not need to spend much on labour regulations and benefits. This abundance of cheap labour is a key factor in increasing the scale of production without impacting the expenses of the companies. It is a win-win situation for both government and corporate as not only is employment generated but it is reasonable enough to not cause a pinch in the pocket.

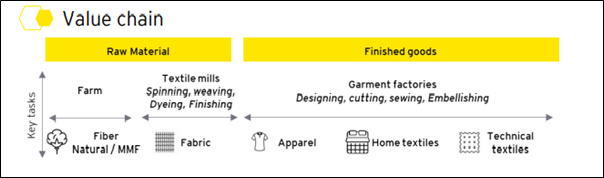

When it comes to land, any manufacturing organisation desires reasonable land rates for a long lease. While India has come up with various lucrative schemes like setting up SEZs or the more recent launch of “Land Banks” at reasonable rates, the hurdle lies in the Centre-State conflicts. Though the Centre has launched numerous benefits for land acquisition for setting up industries ranging from low rates to loan schemes, each state, in turn, has its own policies and benefits. The organisation is often caught in the tangle of red tape between the Centre and State policies which results in unnecessary delays. This acts as a deterrent in comparison to other countries which offer land for industrial development with minimum paperwork and hassles. Also, the extremely high price of industrial land across popular business states causes budgets to go skywards. This same funding which could have been used to purchase latest technology is spent on land leases and purchases and hence companies have to compromise on other factors of industry setup. While the centre is pushing state governments to boost domestic manufacturing of textiles and apparel, the high amount of investment spent on land despite various policies is acting as a deterrent in scaling up domestic manufacturing. Due to this, India is getting limited to being a top producer of raw material for textiles and not being able to scale up to finished products.

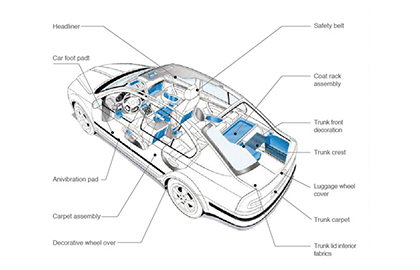

2. System Infrastructure: During the last few years, India has achieved a prominent position in world trade by successfully leveraging its abundant human resource pool coupled with large scale infrastructure with low manufacturing costs. China has clearly been the frontrunner but India has also shown robust growth despite global uncertainties and overall slack demand. The Technical Textile Industry in India has witnessed one of the fastest-growing rates in recent years and is expected to reach $32 billion by 2023, representing a CAGR of 9.6% during 2014-23. While labour and land have played integral roles in boosting performance, the role of system infrastructure cannot be ignored. Despite ranking second in textile exports, India does not feature even in the top three countries producing textile machinery. This dependence on other countries for state of the par machinery coupled with the reluctance of most textile and apparel players to deviate from old norms of manufacturing has largely clipped the wings of Indian textile and apparel industry. Though India excels in spinning and weaving due to its abundance of skilled labour and home employment units across rural regions, other aspects of manufacturing take a backseat in production due to lack of system infrastructure. While countries like Bangladesh and Vietnam do not shy away from purchasing latest technology from textile machinery giants from Europe, India’s reluctance to constantly upgrade its machinery and technology has adversely impacted the level of system infrastructure it would have achieved if it invests a fair share of industry funds into technology upgrades. This has hugely impacted India’s global competitiveness in the textile and apparel industry in a negative manner.

However, where India does gain brownie points is the launch of its “Plug & Play” industry setups across industry friendly states like Telangana and Maharashtra. Data show that availability of plug-and-play facilities for manufacturing can have an overall reduction of around 28 per cent in project funding requirement as well as reduction in project gestation period by one year, having an impact of around 15 per cent reduction in finance cost. This not only provides a breather to companies looking at textile and apparel manufacturing as they can use the saved funds for improving other areas of their manufacturing and exports but it also helps the states with three fold benefits. Firstly, employment is generated and local labour gets an opportunity over migrants thus upgrading the local economy of that particular area. Secondly, the state is upgraded from a raw material producer to a textile manufacturer status which further enhances its image and economy. Last but not the least, revenue is generated by use of connected industries like transport etc . Kakatiya Mega Textile Park in Warangal and Gujarat Eco Textile Park in Surat are perfect examples of such plug and play setups which have not only enhanced system infrastructure but also caused cluster development.

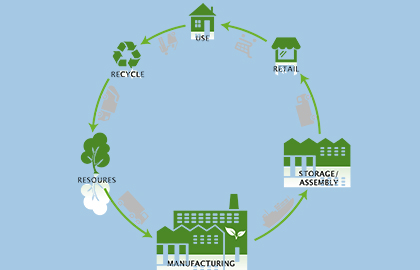

3. Sustainability& Supply Chain: Sustainability has become the need of the hour in this ever-declining state of the environment. With countries making a collective effort to reduce carbon footprints and improve global pollution due to industrialisation, the only way forward is sustainable manufacturing of textiles and apparels. Indian textile players have taken the responsible step towards sustainable manufacturing by harnessing solar energy, minimising the use of chemicals and air pollution and reusing water as much as possible.

The supply chain is also an integral part of sustainable manufacturing as an efficient supply chain ensures minimum use of resources. Luckily for India, an abundance of production of raw materials like cotton, jute, wool and silk has ensured that manufacturing industries always have an efficient and smooth supply chain of raw materials. The launch of schemes like “Atmanirbhar Bharat” has assisted new players to jump in the booming textile industry and take bold steps towards being a part of the supply chain.

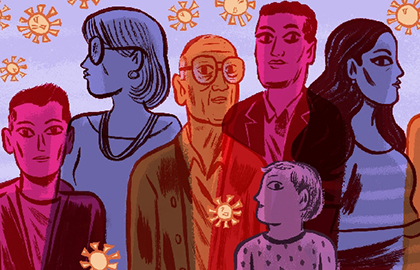

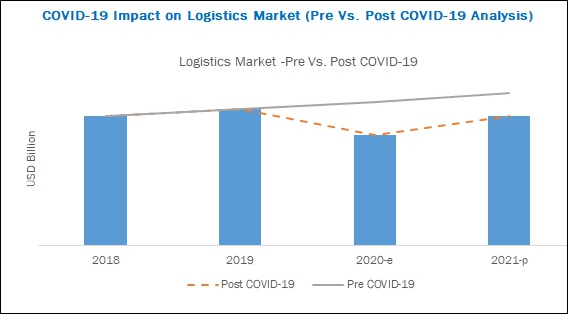

The entire world witnessed a standstill with the attack of the coronavirus this year. Needless to say, supply chains were brought to a complete halt. Even post lockdown when the world is gradually taking baby steps and adjusting towards the “New Normal” most countries, including US and the EU are deeply impacted by the COVID-19 pandemic and have witnessed a sharp decline in retail and online sales. India on the other hand has sprung back with new wind beneath its wings. Though sales are yet to hit the old normal, initiatives by the governments and efforts by the companies have ensured that our supply chain is back to almost pre covid times. Infact keeping in mind the new normal, several adjustments have been made and new measures taken which have further enhanced our supply chain. This coupled with successful steps taken towards the use of sustainable methods of manufacturing has helped India firmly plant its flag in the top sustainable manufacturers of textiles and apparels in the world.

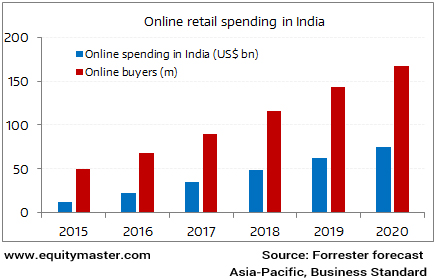

4. Smart Manufacturing: This year of lockdown has clearly illustrated the importance of e-commerce in the current age. Though retail will never really go out of fashion (pun intended), e-commerce has swiftly overtaken retail as the biggest platform for purchase in urban sector amongst millennials and generation Z. Apparel giants like Zara are employing data analytics to get an insight into consumer needs and manufacturing as per their tastes and preferences. Not only is this ensuring quicker sale off the racks but it is also saving time and resources. This “Smart Manufacturing” is the need of the hour and countries who can adapt themselves to include this as part of their manufacturing tactics will truly rule the global apparel industry. Though India abounds in e-commerce sites and is the fastest-growing e-commerce market in the world, it still has a long way to go if it wishes to compete with the top countries in this sector.

Indian textile and apparel manufacturers need to step up to Industry 4.0 technology upgrades which are being adopted worldwide. While few companies have taken the initiative to shift towards the making of “Smart factories” most organisations are reluctant due to the initial investment and change in strategy. They are more comfortable with the existing ways of manufacturing which have been coming down generations and believe in making disposing machinery away after its completely worn down rather than investing in wear and tear costs from time to time. This short term vision is hampering India’s growth in textile and apparel market as its competitors are going full scale into Industry 4.0 .

5. Shining India: While the above factors are essential to set up India’s position in global textile and apparel industry, initiatives taken by the Government are essential to make or break India’s position globally. Backward countries like Bangladesh are in the risk of zooming ahead of us due to lower wages and the perks they receive globally as a backward country like FTAs. Being one of the largest developing nations in the world, India has a lot to deliver. Indian government has seriously taken this challenge under its wings and launches numerous schemes like “Atmanirbhar Bharat”, “Make in India” and “Make for the World” to provide benefits to domestic manufacturers. The setup of plug and play parks and the easing of FDI have also lured many foreign companies to setup base in India and increase our manufacturing volume.The launch of “Kasturi Cotton” and the newly improved Agricultural Reform Bills have propelled domestic textile manufacturers to reach newer heights. India stands to shine higher with the support it is receiving from its administration.

So how exactly is India placed globally in the textile and apparel industry? Yes, we are second only to China but the question to be really asked is “For how long?” India’s performance, when compared to many competing countries, has not been very encouraging and it faces serious threats from tiny nations like Bangladesh and Vietnam. Bangladesh provides stiff competition to India’s availability of cheap labour as Bangladesh does not follow most labour laws and manufacturing there is cheaper than in India. Vietnam has raced ahead as the new outsourcing hub due to the back support provided by China. While China may have suffered largely in the post-COVID era today, India who was initially deemed as the winner from the negative impacts on China from the US trade war and the adverse effects of COVID has not reached the expected heights. Countries like Vietnam and Bangladesh have raced ahead as the new favourite outsourcing hub for international garment makers, including those leaving China. Vietnam is now the world's third-biggest garment manufacturing nation, while tiny Bangladesh's garment exports rose from $26 billion to more than $33 billion in the last five years, while India's has remained stagnant at around $40 billion.

However, there is hope at the end of this tunnel. India still ranks high in the abundance of raw materials and large scale production. Manufacturing industries in India are keeping up with current times by constantly upgrading their units towards sustainable and smart manufacturing. India is shining still and while there may have been hurdles in its journey to becoming the top textile and apparel manufacturer in the world, the dream is not impossible either. The onus largely depends on initiatives and steps being taken by the Government of India to enhance domestic textile manufacturing. In the words of Ravi Capoor, Secretary, Union Ministry of Textiles, “Various countries are looking at Indian markets and it's time to gear up supply chains, quality, and deliver at the promised schedules, which will enable India to become a market leader.”