Investing in the Indian Textile Market in 2020 - An Overview

Production & Export of Safety Wear

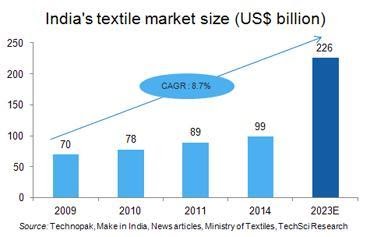

The Indian domestic textile and apparel industry contributes 2.3% to India’s GDP and constitutes 13% of the country’s export earnings. Exports in the Textiles & Garments industry are expected to reach US$ 300 billion by 2024. Hence, it is no surprise that the last decade has seen an influx of clothing and textile brands in the Indian market. With its domestic consumption of US$ 97 billion and exports worth US$ 40 billion, India has emerged as the third-largest consumer market and the fifth-largest textile exporter in the world.

The year 2020 has, however, drastically impacted all sectors due to the ongoing pandemic. While some industries like the health sector have seen an upsurge, others like the aviation have plummeted to unforeseen lows. As we all know, manufacturing and export came to an abrupt halt for complete two months due to COVID-19 lockdown. Despite this, the good news is that Indian Textile industry is not only jogging back to track but has also adapted itself to the current market scenario. The industry accounts for 12% of Indian exports. Investment in Indian textile market is luring both national and international players due to various factors.

Production & Export of Safety Wear

This year can be declared as the year, which made “Safety Wear” like masks and gloves mandatory items in the monthly household shopping list. Yarn manufacturers have modified their manufacturing units to now produce safety masks and gloves. The use of polyester viscose yarn in hand gloves, which are now a daily-use item when stepping out; the use of polyester cotton yarn in face masks and the use of blended cotton yarn in PPE suits and surgical gowns, etc. has provided a whole new sector for the textile industry. With a population of over 1.380 billion in India alone, the mandatory requirement for people to use this safety wear has caused a big boost to the textile industry. The government’s decision to allow export of non-surgical masks has also catapulted the textile industry to new heights.

Business-Friendly Government Policies

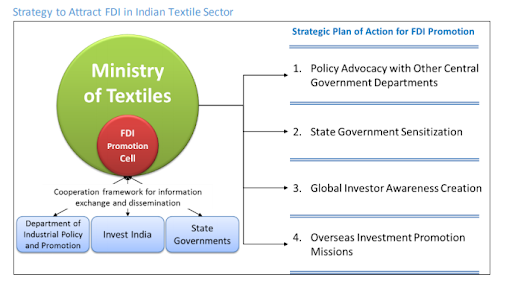

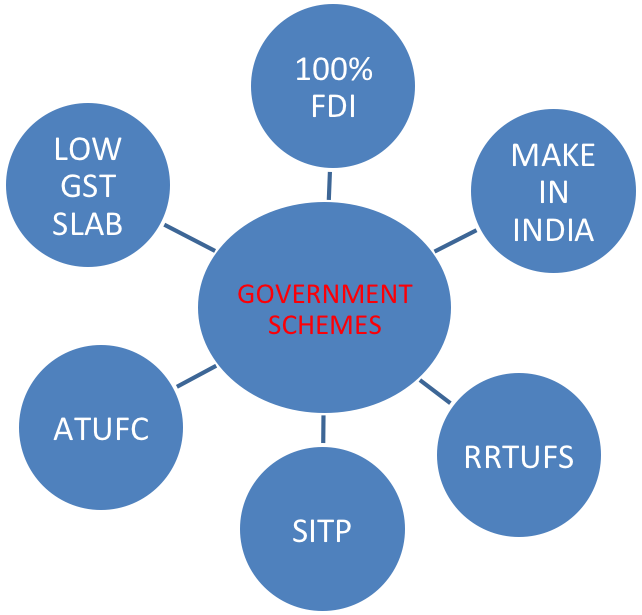

With 100% FDI being allowed in the textile sector under the automatic route, numerous clothing brands like Scotch and Soda, Simon Carter, Steve Madden etc. made a beeline for the lucrative Indian market.

The implementation of the Scheme for Integrated Textile Parks (SITP), Revised Restructured Technological Upgradation Fund Scheme (RRTUFS) and the Amended Technology Upgradation Fund Scheme (ATUFS) by the Ministry of Textiles, India has minimised industry setup cost, making it approachable for small and medium-sized yarn manufacturers to enter the market. Lowering the GST slab to 5% has also boosted the growth, creating a business-friendly environment. Policies like “Make in India” are further promoting demand for Indian products for the national market and paving the way for new factory setups in the textile industry.

The new textile policy, slated to release by early 2021 will be a game-changer. It will not only address the potholes of the ongoing policy but also wrap the Indian market in an attractive package with many new enticing schemes.

Cost Efficiency

India is one of the most cost-efficient textile manufacturing countries in the world. As per the report by ITMF on international product cost comparison, India is the third-most competitive country in terms of ring-spun yarn manufacturing. This can be attributed to low labour cost and ample availability of raw material. Low cost based on cheap labour has been the main reason why the textile industry in China has enjoyed extraordinary growth in the last two decades but with the average wage reaching there at US$ 600 a month, India has become a lucrative option for cheap and readily available labour.

Textile industry in India, as a whole, ranging from blended cotton yarn manufacturers to heather yarn manufacturers employs approximately 100 million people - directly and indirectly. The easy availability of labour coupled with the Integrated Skill Development Scheme has proved pivotal in tipping the scales towards manufacturing textiles in India.

Consumer Market

The smartphone boom in India has globalised the Indian consumers. Purchasing for brands which were earlier limited to metros has now made its way to Tier 2 and Tier 3 cities both via retail and e-commerce. This has radically increased the demand for production in numerous sectors, including the textile industry. Add to this is the fact that India has the second-largest population in the world and out of this, 65% are below the age of 35. This is ground enough to ensure that India has emerged as one of the largest consumer markets in the world. Hence, not only are international textile players vying to enter Indian retail market but new, emerging textile manufacturers are claiming a piece of the pie as well.

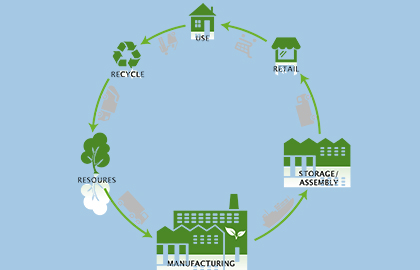

Sustainable Fashion

The twenty-first century has been labelled as a century of awareness. Escalation of environmental issues like global warming, lack of recycling, plastic wastes etc. have channelled the younger generations to move towards sustainable fashion solutions. Hence, synthetic fabrics have largely been replaced with natural ones like organic cotton, peace silk and wool. With India being the second-largest producer in cotton and silk and the ninth-largest producer in wool, textile companies manufacturing in India need not look outside for raw materials.

The rise of khadi as the ultimate fashion choice for the environmentally aware generation has shifted the focus even more to Indian markets. A symbol of self-sustenance and minimalism, khadi is a top-selling fabric. With India being the birthplace of khadi, it is but obvious that textile manufacturers of sustainable fabrics consider India as their top choice.

Today’s Indian market is expanding with gigantic leaps. With its diversity in lifestyle, India has space for both national and international brands to co-exist in harmony. The pandemic has also ensured that the textile industry has received a whole new segment of manufacturing in the healthwear segment. What seemed as a lull has turned out to be the silence before the boom. In the words of Gautam Adani, “If there was a time to make a bet on India, there may not be a better time than now”.