Kids Apparel Industry in India

The rise in demand for Kids Apparel post the lockdown

The growing market demands of Apparels for the ‘Growing Ones’

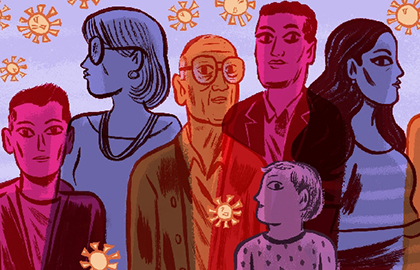

In 2019, the Kids Apparel market in India crossed the US$15 billion mark. The nature of the Indian consumer to be influenced by the western culture, along with the increased spending-capacity of the average Indian parent, is one of the major reasons for this spurt in growth. Online shopping culture is another factor. At a CAGR of 10.5%, it is expected that the Kids apparel market will be of US$22.4 billion by 2023, which is around 22% of the total Indian Apparel market.

The Boys’ apparel market is somewhat better performing than the demand for Girlswear, but it is estimated that the gap will be bridged in the coming years. In 2019, the Boys’ apparel market was US$4.3 billion, and growing at a CAGR of 10%. In the meantime, the Girls’ apparel market (US$ 4 billion) is growing at a rate of 11%.

The rise in demand for Kids Apparel post the lockdown

The sales of Kidswear saw a rapid growth in numbers at the end of the 40-day lockdown period. While online e-commerce sites like Myntraa, Amazon and Flipkart recorded almost a three-times increase in kids clothing orders, local shops also recorded the higher customer traffic, as parents hurried to replace the wardrobes which their kids had outgrown during the lockdown.

The kidswear is a major part of the Textile industry and is presently growing at a CAGR of 17.9% (Source: Euromonitor India). With the kidswear segment accounting for almost 20% of the total apparel market in India, the estimated value is expected to cross Rs. 1.7 trillion by 2028. A huge customer base of an estimated 120 million children between the age group of 0-4 years and approx. 250 million children between 5-15 years, it provides a huge lucrative market for the Indian kids apparel industry. It is expected that by 2023, this segment will grow faster than the dominating menswear and womenswear segments, with a huge focus on the new-born babies and toddlers’ selection. The toddler-wear sales have witnessed a steady 100% YOY (year-on-year) sales for the past couple of years, with the majority of sales drivers being Tier-2 and Tier-3 cities from Maharashtra, UP, Karnataka and West Bengal.

Factors influencing the growth of Kidswear:

- Initially, the entire market was depended on the secondary buyer, as parents were the ones to choose for the kids. However, today’s fast-paced generation of buyers has shifted this anomaly and now, kids have become the decision-makers, along with a larger freedom of ordering their own clothing.

- Double-income nuclear families have increased the spending capacity of each household, along with the changing mindset and buying behavior of the typical Indian parent, who is now willing to spend more.

- Health concerns for babies have naturally increased the sales of organic baby clothing, along with safety concerns like flame-resistant Class 1 textiles (with flame spread of more than 7 secs.) clothing. The concern of parents regarding the adverse effects of harmful dyes and chemicals on the baby’s skin have resulted in their willingness to pay more for better manufactured apparels.

- The diversity in designs and competitive pricing is the deciding factor for Kidswear. The consumers want more variety and at a cheaper price. This has been possible with the increased number of players that led to the growth of the industry.

- Better marketing practices, farther outreach through advertising, better customer awareness and more efficient logistics and delivery systems have catalyzed the market growth.

- Being a country of diverse cultural practices, the manufacturing of kids-centric ethnic and traditional wear has become one of the largest consumer markets today.

Entrance of larger players in this domain:

Over the years, there were only a handful of textile companies that focussed solely on Kidswear. Brands like Gini and Jony, Weekender, Firstcry and Lilliput were some of the preferred brands. However, this scenario has changed with many other brands diversifying into this section.

Raymond, textile giants in Mens’ Fashionwear, came up with their own brand, ‘Zapp’, for kids apparel. The collaboration of Walt Disney and Warner Bros. with Weekender to launch their new collection, named as ‘Toon World’, enables the use of cartoon characters in the new line of clothing. ‘Ruff’ kids brand, managed by DS Corporation, is on a rapid expansion spree in the recent years. Even the most favorite kids TV channel, Cartoon Network, has launched its own set of clothesline, which includes the latest cartoon characters as part of the kids’ wardrobes. This is also followed by a number of international brands like Little Kangaroos, Cucumber and Chicco expanding their customer base in the Indian sub-continent. Major players of Men’s and Women’s Fashion wear and Sportswear have also joined the race, with Gap, Zara, Puma, Benetton Group, Marks & Spencers, Dolche & Gabanna, Levi Strauss, Diesel and DKNY entering the kids and baby wear industry in India.

However, even with the big brands emerging from the market, the small players and local shops still consist of the larger part of the contribution. The major challenge for the kidswear industry is the short life-span of the usage, as kids tend to outgrow them rapidly. Even though the higher pricing of clothes and shoes are not much of a concern, it is the lack of long-term use, which is forcing manufacturers to create cost-effective clothing. Nonetheless, this doesn’t change the fact that this industry is one of the most lucrative ones, with a huge scope for growth in the coming years...