Why does the power loom sector seek relief in the anti-dumping policies of the Govt.?

What does anti-dumping duty mean

A few days ago, news concerning the anti-dumping duties imposed on imported nylon filament yarn, was making rounds in the power loom weaving sector, much to the disappointment of weavers. The Directorate General of Trade Remedies (DGTR), the body responsible for overseeing these policies, announced anti-dumping duty between 5% and 16.9% on different kinds of yarn. At a time when the industry is looking bleak and on the verge of getting back on track, this has proved to be a nightmare and the step has found opposition from various weavers and governing bodies.

The Confederation of Indian Textiles Industry (CITI) has sought measures to help stabilize this situation, by requesting an exemption for cotton yarn, nylon yarns, and fabrics under the ambit of RoSCTL, IES and MEIS benefits. In a letter to the deputy secretary of Dept. of Revenue (Govt. of India), the textile ministry explained how the nylon multi-filament yarn is a key raw material in the industry and requested removing the anti-dumping duty. Presently, the anti-dumping duty proposed on imports from China, Thailand, South Korea, and Taiwan range between ₹ 30/- and ₹ 70/- per kilo of yarn.

What does anti-dumping duty mean?

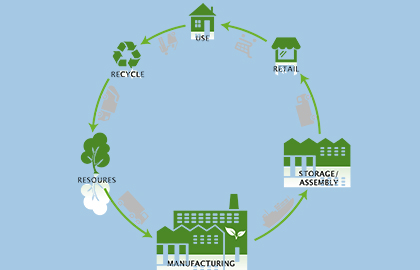

In terms of trade, ‘Dumping’ is a process wherein a country or company exports products at a price lower than that in its own home market. This leads to a chance of massive fluctuations in pricing, as well as a monopoly by a single player in the free-trade market. To avoid this, anti-dumping duty is imposed on imports as a protection measure to keep a tab on unfair trade practices.

What are the effects of imposing anti-dumping duty on Indian textile market?

The textile industry is going through a huge market crash due to the ongoing pandemic, and it will take time for the industry to recuperate. In this scenario, imposing anti-dumping duty on raw materials like cotton and nylon leads to an increase in price by 30% per kilo of yarn. This may lead to weavers and power loom houses to either reduce production or completely shut their units due to unaffordability.

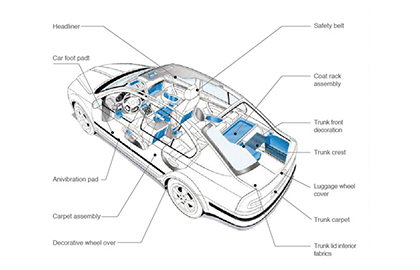

Presently, the Indian textiles contribute to 40% of manmade fiber demands of the country, with more than 6.5 lakh power loom machines weaving a whopping 3 crore meters of nylon cloth per day, or 6 lakh metric tonnes per year. It is estimated that a shortage of 600 million kg will be experienced in 2020, due to anti-dumping duty. Nylon fabrics are majorly used in manufacturing of parachutes, knitted garments, in technical textiles and commercial textiles. There is a good chance of a domino effect, which can leave other industries in doldrums.

However, steps are being taken by textile governing bodies, including the Ministry of Textiles and CITI, with a hope to get the scenario stabilized and under control. In recent times, the textile ministry has opposed the DGTR recommendations of imposing the anti-dumping duty on nylon multi-filament yarn. This comes as a major relief for the powerloom weaving sector. The effects of this will be visible in the near future, while the industry focuses on returning to normalcy soon.